DJ Quixote's Adventures in La Manufactured Housing

TMHA’s Executive Director’s Response to the Consumer Finance Protection Bureau’s White Paper on MH

This is my third attempt at writing this article. I had to trash my two previous efforts.

After a bit of time, a bit of reflection, and a bit of perspective I’m giving it another shot. This third attempt was born from my previous efforts to understand why I was having such a difficult time penning a response to the CFPB white paper as more discarded paper accumulated around my desk. The only reason I can determine is that like the self-proclaimed knight, Don Quixote, turned crazy by an obsession of returning to a world of chivalry, I have at this point been driven…nuts.

The experiences I have had over these last few years reading federal laws, proposed regulations, final regulations, interpretations of regulations, readiness guides, flowcharts, and watching hearings, have finally infected my brain in a way that has put me on a course, for this article at least, into a world of perception distortion and fantasy. Similar to Don Quixote’s obsession that he was a knight out on a noble quest, my incessant reading of CFPB publications has cast me down a path that is no less fantastical. Rather than fight against this effect, I’m choosing to steer into the mental skid.

There are many industry responses on the recently published CFPB white paper on manufactured housing. Those lamenting the inadequate attention the Bureau gave to realties in our market and glancing over things like cost of funds, interest rate risk, borrower risk, lack of secondary market, and portfolio based lending are all well founded. For more on this I’d suggest Dick Ernst article Deconstructing the High Cost Mortgage Loan. In my two earlier drafts I did this too. And for follow up articles after I come back from my journey today atop my skinny stead, Rocinante, I might publish them as well.

But not today.

Today I’m asking that you travel with me and my trusty sidekick, Sancho, off into a distorted reality of a world of my creation. So indulge me for a little while, even if some of the suggestions are as preposterous as fighting windmills I believe to be giants. For this is my Don Quixote journey compelled by my most recent reading of the CFPB white paper on manufactured housing.

Background

Before jumping into my La Mancha, a quick bit of context could be helpful for those not as familiar with recent CFPB happenings. On September 30, the CFPB published a white paper on manufactured housing. If one were inclined to give the CFPB the benefit of the doubt, you could conclude they tried their best to present an objective analysis of our industry without injecting any intentional or unintentional biases. Of course, there are those that will assert they did not achieve this, and others still that claim this was never their intention. My goal will be to stay more positive than the cholericly tempered literary counterpart in my feeble attempt at analogy, but forgive my moments of weakness when certain angers are irrepressible (Note: I’m trying to up my level of analogy by turning to classic literature, but worry not as I’m sure Star Wars and Lord of the Rings themed articles will dominate my future efforts).

The white paper identifies the following seven “key findings:”

- Manufactured housing is disproportionately located in non-metropolitan areas.

- Compared with residents of site-built homes, manufactured-housing residents are somewhat more likely to be older and tend to have lower incomes or net worth.

- Manufactured homes typically cost less than site-built homes.

- About three-fifths of manufactured-housing residents who own their home also own the land it is sited on.

- An estimated 65 percent of borrowers who own their land and who took out a loan to buy a manufactured home between 2001 and 2010 financed the purchase with a chattel loan.

- Manufactured-home owners typically pay higher interest rates for their loans than site-built borrowers.

- The current state of manufactured housing production, retail, and financing reflects in part a rapid growth during the 1990s and subsequent sharp contraction.

If you would like to see the press release from the CFPB you can find it here: http://www.consumerfinance.gov/newsroom/cfpb-finds-majority-of-manufactured-housing-borrowers-have-expensive-loans/

If you want to read the 54 page white paper you can find it here: http://files.consumerfinance.gov/f/201409_cfpb_report_manufactured-housing.pdf

I’m not going to address in detail or systematically attack the CFPB assertions. Quite the opposite.

I’m going to assume the basis for the examination of our industry and the subsequent white paper was intended to drive future policy based decisions and discussions. Where I might differ with the regulators is where I think the facts they have compiled should direct us, and the questions it brings to light that should be the focus of their future efforts.

However, I have a feeling my policy proposals will only come to be in fantasy and not in reality. But come on Sancho; I’m sure this will only hurt a little.

Here is my list:

- Why is manufactured housing disproportionately located in non-metropolitan areas? Shouldn't the policy be of inclusion and consumer choice rather than exclusion and limits?

- Wouldn’t it be nice if the housing playing field were level, markets not artificially influenced by selective polices, and either the removal of subsidies or, alternatively, bring the subsidization to manufactured housing to compete, rather than stacking the deck against us?

- Why was there no attention given to existing state laws, regulations, consumer complaint levels and consumer notices? And why does the white paper read as though there is a critical and immediate need for more regulations and notices?

Why are Cities Still Allowed to Hate Us?

The white paper does list factors as to why manufactured housing is more of a rural housing option and not in more populated metropolitan areas. They mention zoning prohibitions as a contributing factor. Those of us in the industry know this is the factor limiting manufactured housings’ presence in urban settings. The question this should spawn is whether or not it is good policy to allow cities this type of prohibition. With new, modern, efficient, heavily regulated manufactured homes, what is the public policy that benefits a city from prohibiting manufactured homes and what are the benefits to removing these restrictions?

My case for the latter is simple – in city zoning restrictions modern manufactured housing should be treated exactly the same as all site-built residential construction. Equality. This would create a world where any type of discriminatory treatment directed exclusively towards manufactured housing placement is void.

Now some regulators and city officials might scoff in stern disagreement, but why?

Whatever the city restrictions are for site-built housing placement have those apply equally to manufactured housing. The preemptive federal construction code and state installation requirements modeled from the national standard satisfy any safety and soundness concerns. Allow these standards that insure the homes are not substandard to serve the purposes they are intended. And if a city decides to impose some sort of home aesthetic mandates, energy efficiency standards, or any other requirements (so long as they don’t interfere with the federal construction or installation codes), simply require the standard to apply to all housing equally. This would allow manufactured housing to compete on the same playing field and increase consumer choice.

Another reason this is good policy is to consider the benefits the economy and labor force receive through a manufactured setting.

We are talking about factories with skilled, well paid, middle class, labor jobs. They draw paychecks, pay taxes and receive benefits. Not to mention worker protections and oversight from internal safety and quality control, to regulatory oversight and redress like worker’s compensation protection and OSHA. They are also U.S. jobs that are not outsourced.

In manufacturing you have greater efficiency in construction, less waste, organized and predictable supplier networks benefiting those producers down the line. How is it that this reality isn’t championed like other manufacturing industries?

How much more do you think your car would cost if instead of being produced in a factory all the parts were shipped to your driveway where contract workers showed up and built it on site. How long do you think it would take to build it? What about your television? How about your cell phone? If the market is allowed to work without manipulation efficiencies in production lower costs allowing some consumers the opportunity to pay less for an equivalent product. The white paper addresses the fact that on a square foot basis manufactured homes cost less than half as much as the estimated $94 per square foot site-built home.

Some consumers would like to have this choice when it comes to housing. And for others it would open up the chance for them to be homeowners who otherwise would not because they were priced out of the site-built market.

And yet, I’m not even advocating for a wild swing in the pendulum away from site-built to manufactured housing. I’m simply saying remove the non-level playing field, and allow us to compete equally.

Could the CFPB impact this? Sure.

With its broad authority and charges for greater equality, fair housing, transparency and consumer choice there are measures the Bureau could take to level the field.

One quick suggestion, when dealing with a new manufactured home in a metropolitan area that conforms to the federally mandated code and equivalent site-built restrictions for a given area, in order for a local government to pass a housing restriction on only manufactured housing and not any other residential housing, they must demonstrate an overwhelmingly compelling reason as to why they believe such a restriction is superior policy. In their required justification they would have to defend why their selective exclusion would not have an adverse or disparate impact on housing choice and any protected classes such as families who would like to live in something larger than a one-bedroom apartment or elderly retirees on fixed income who need a lower cost home choice. Failing to meet a much higher burden in ordinance creation would result in the ordinances being deemed void as either against public policy or a violation of fair housing ideals.

I know, such things are crazy talk from a guy wondering around in the sun in an old suite of armor. Completely irrational, right?

Well, I got the outfit on, and I’m on the damn horse so I might as well go for it, so here it goes. The CFPB is big on consumer notice and consumer choice, so why not add a consumer notice for any site-built home being financed that says, “WAIT. Before you sign, did you know you might be able to buy an equivalent house for less than half the cost per square foot of this one?” The same notice mandate could be applied to Fair Housing regulations requiring disclosures prior to a home purchase or a residential rental that a manufactured housing option would be hundreds of dollars less per month in all-in housing costs.

Reading between the lines of the white paper it sounds like more notices and warning mandates are coming down the pike for the manufactured housing industry, so I’ll ask another crazy question. Why don’t we ever get notices showing our clear advantages for consumers?

Where are you supposed to live if you make $26,000 year?

The demand of affordable housing is undeniable. As incomes stagnate and living costs increase the demand for affordable housing will continue to grow. The manufactured housing story in this equation is one of “haves-and-have-nots.” But in our story the multi-billion dollar issue is subsidization. And we are in the “have-not” camp.

Any way you slice any of the myriad of “affordable housing” incentives or programs, at their core is government subsidization. I know there are the Libertarian minded readers out there disgusted at the idea of government subsidy. And similar to the city ordinance restriction argument I previously made, all things being equal and all subsidy removed, I know manufactured homes would compete for a much higher market share of housing.

However, while I’m admittedly crazy in this current effort, I’m not crazy enough to ever think all subsidization in all forms could practically be removed. I might think I’m a knight on a horse, but I’m not so nuts to think I’m the back-end of a horse (though some may beg to differ).

Instead, this Don Quixote is on a different quest of insane ideas. If you are going to subsidize programs to foster home affordability, why don’t you provide subsidy and incentive to clearly the most affordable housing option of manufactured homes?

Manufactured housing is, at times, somewhat eligible for some types of current programs. But in practice the government policies and attentions applying affordable housing subsidy in large scale to manufactured housing are more of a unicorn than an everyday work horse.

The subsidy is pervasive starting at the federal level, but also at state and city levels. Site-built and multi-family developers are granted incentives, tax breaks, and many other subsidies if they are building affordable homes or units. Most of the time the requirement to get the subsidy is that only a small portion of the total development provide affordable options. This is most common in apartment construction, but site-built and condo development also share in these subsidy treasures.

I know I’m the crazy one on the horse here, but let me see if the sane world has clearly figured this out.

The government will provide incentives, tax breaks and subsidy to build affordable housing that only serves a small percentage of the total development, then additional government subsidy is layered on to the buyer or renter in down payment assistance, reduced principal programs, subsidized lower interest rates, forgivable loans or rental housing vouchers to get people into “affordable housing.” I’m sure this makes perfect sense to everyone else, but in my clearly delirious mind it begs the question, “Why not just focus on housing that costs the least?”

Granted, there is a lot of dangerous substandard housing. The Colonia problem in Texas to name just one. But for safe, efficient, and easily replicable affordable housing, how is it that manufactured housing is either ignored or purposefully overlooked?

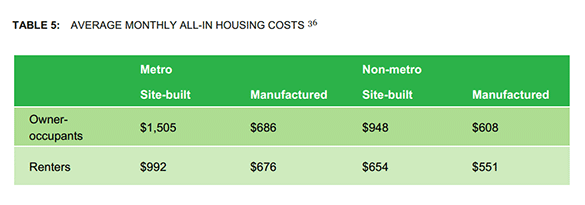

The white paper provides the facts on the superior affordability of manufactured housing in Table 5 when they compared manufactured housing in both metro and non-metro areas to both site-built and renters. Manufactured housing was less expensive ranging by more than half the monthly costs (metro site built $1,505 to metro manufactured housing $686) to about $100 less per month (non-metro rental $654 to non-metro manufactured housing $551). This means we win in all categories in all locations on affordability.

(http://files.consumerfinance.gov/f/201409_cfpb_report_manufactured-housing.pdf)

If manufactured housing is the least expensive compared to any other safe, regulated, quality living accommodation, then imagine the benefit of subsidization directed at manufactured housing. Wouldn’t such a crazy idea better serve the goal of providing affordable housing to more people?

Coming out of the recent housing crash, the idea of people choosing a home they could afford and living within their means seemed to penetrate the psyche of most of America. However, there seems to be some terrible stigma in maintaining this simple idea, even in the context of affordable housing, if the result is a conversation about homes that cost less than $100,000, less than $70,000, less than $50,000 and especially homes below $30,000.

Why?

If the home is regulated to ensure consumer safety, efficiently produced, and in nearly all cases larger than any other option at a similar price point, why then is the idea so ludicrous that this might be the best choice some buyers or renters could make?

I can’t get an answer out of my horse or Sancho on this, so I guess I’ll have to accept the idea that the saner approach for a person who can only afford a $45,000 house is to live in a $165,000 house with $120,000 worth of combined developer and individual subsidy attached to it.

It sure seems to make sense that subsidy dollars could go further and help more people if applied to the type of housing clearly superior in affordability. But then again, I’ve lost my marbles.

By the way, just under $40 billion was budgeted to be spent by HUD for all of its subsidized affordable housing programs in 2012, and this does not include any of the loan guarantee dollars and authority to incentivize securitization of mortgage loans that drastically underutilize manufactured housing.

I’m not saying manufactured housing programs should receive all or even the bulk of the subsidies. I’m merely suggesting that when doling out billions of dollars some focus and some programs specific to manufactured housing should be adopted. Such programs would better achieve the goals of providing safe, affordable housing while preserving the dignity and self-worth of recipients who receive the benefits.

Notice, Transparency and Consumer Protection

The white paper has been read by more than just this crazy rider as a volley of shots across the bow and foreshadowing of possible new regulations for manufactured housing.

Here are just a few excerpts:

“At the same time, these same groups include consumers that may be considered more financially vulnerable and, thus, may particularly stand to benefit from strong consumer protection. “

“Thus, manufactured-home owners who can choose either chattel or mortgage financing (generally, those who own the land to which the manufactured home is being permanently affixed) may face a tradeoff between lower costs at origination and a quicker closing with less collateral, on the one hand, and lower total costs over the life of the loan along with greater consumer protections on the other.”

“The extent to which consumers are aware of theses tradeoffs and how consumers weigh them remains an open question. It is not clear to what degree upfront costs and convenience, lack of availability for mortgage financing, or lack of relevant information about financing options drive consumers to chattel financing.”

“Chattel loans may close more quickly than or have lower upfront costs than loans secured by real property, but chattel loans tend to have higher interest rates and provide borrowers with lesser consumer protections than mortgages secured by real property.”

“The relative scarcity of data on manufactured housing compared with data available on site-built housing and mortgage finance in general remains a challenge for research related to manufactured housing. This gap in data availability may begin to narrow, however, in the coming years.”

“The classification of some manufactured-housing retailer activities as loan originator activities provides consumer protection for homebuyers in what may be a high-pressure sales environment.”

However, nowhere in the white paper, in particular when addressing consumer protection and apparent perceived abuse by the industry, does the paper mention state law or state regulation. Manufactured housing is arguably the most regulated form of housing stemming from both the federal level and state level.

At least in Texas there are numerous consumer disclosures and cooling off requirements prior to buying to address the often mentioned “high pressure sales.” Texas also has a three day right of rescission for all consumer funds. In fact, in Texas the consumer is so protected that an equivalent contract agreement that exists in the site-built world were a buyer may end up losing earnest money is not allowed in Texas for a manufactured home purchased from a licensed retailer.

The CFPB fails to acknowledge that state regulators and auditors are enforcing consumer protection laws and regulations. These state level “cops on the beat” audit consumer files to ensure disclosures are provided, and the goals of consumer choice and transparency are achieved.

In Texas, there is also a specific chattel manufactured housing lending regulator, the Office of Consumer Credit Commission. With existing state laws and regulations this additional regulator is there to protect consumers who obtain chattel manufactured home loans. Texas state law requires any chattel loan contract contain the name and contact information of the OCCC notifying all Texas chattel manufactured home borrowers who the consumer protection regulator is and how to get in touch with them to file a complaint.

The white paper implies there are great injustices and consumer harm befalling those extremely vulnerable who are forced, as a last result, to purchase manufactured housing. The CFPB’s perception of consumer harm prompts them to allude to future CFPB regulation. But before we run to put out some blazing inferno, maybe we should ask if there is even a fire burning.

Let’s look at Texas’ manufactured home chattel financing. In 2013 HMDA data shows there were 7,094 manufactured homes sold with financing in Texas. The titling data at TDHCA actually has the number of chattel financed manufactured homes sold in 2013 at 9,759. As many institutions are currently exempt from HMDA reporting, and by the CFPB’s own admission the HMDA data is lacking when it comes to manufactured homes, we are going to use the Texas titling data. However, in order to align with the fiscal year used in the reporting of the OCCC, the apples-to-apples time frame we need is August 2012 through September 2013.

In Texas we had 9,509 manufactured homes sold with chattel financing between August 2012 and September 2013. In this same time frame the total number of consumer complaints processed at the Texas OCCC for manufactured housing lenders of chattel loans was 15. This means the percent of complaints compared to chattel manufactured home loans is .157 percent. I hope I’m not being too crazy to think that any industry would love to have less than 1/5th of a percent as their ratio of consumer complaints to sales.

I know the skeptics and supporters of increasing regulation might take issue with my facts. In order to cover all my bases I also looked at the CFPB’s own consumer complaint database. According to the CFPB their complaint database for mortgages dates back to December 1, 2011. The complaint data does not distinguish manufactured home from site-built, nor does their mortgage category separate chattel from real property mortgage loans. But you can filter to just mortgage complaints in Texas where the consumer disputed the company’s (lender or servicer) response. When you filter the data to those categories there are 1,419 consumer disputed, mortgage complaints in Texas. Again, we can’t narrow down the complaints to chattel manufactured housing, but the companies’ names are listed. Based on the names of the common lenders who make or service manufactured chattel loans, the total count I have for companies who possibly have chattel mortgage complaints lodged against them with the CFPB is 64. Obviously, all 64 of the complaints are not manufactured chattel loans, but there is no way for me to tell with the data presented. It is easy to assume, especially with manufactured housing accounting for only 7.6 percent of the Texas housing stock that if one were able to dissect the 64 only a small percentage might be manufactured housing chattel based complaints.

But let’s err on the side of very conservative assumptions. Let’s take all 64 as if all of them were the result of consumers complaining about chattel mortgages on manufactured housing in Texas. Since December 1, 2011 when the CFPB database begin populating complaints on mortgages through July 31, 2014 there were 23,292 manufactured homes sold with chattel loans in Texas. Again, knowing the real number is lower, most likely much lower, than 64, but using that for a conservative estimate the ratio of complaints to sales with chattel loans is .274 percent.

In the face of this data, I’m forced to take off my helmet to scratch my head in confusion. Where is the extreme injustice? Where are consumers being harmed at such startling degrees that require significant federal regulatory reaction?

Let’s assume it is impossible to eliminate in any market all consumer complaints. If everyone can agree zero consumer complaints is not possible, then there must be some threshold goal. Ideally this goal is very low. In my delirious state I might suggest that less than half of one percent is very low. Everyone should further be able to agree that any additional regulation comes with additional costs that must be absorbed, almost assuredly in the form of pass through costs to all consumers. There is also the reality of diminishing returns triggered when each additional costs only produces fractional changes. The question then is, how much consideration and cost benefit analysis is being done when additional regulatory burdens are contemplated? If the reporting by consumers of all alleged harm is incredibly low, but the cost of additional regulations with the goal of reducing consumer harm further are felt by 100 percent of the consumers, is the additional regulation really in the best interest of the consumers?

I’ll put this another way. I’ll put it in the form of a consumer disclosure and consumer choice.

Consumer Notice: This industry historically experiences less than half of one percent in consumer complaints. Knowing this would you choose to pay an additional $175 to lower that amount by an additional .002 percent?

Obviously Ramblings of a Crazy Old Coot

Clearly many of the points in this article are being made with hyperbolic language, rhetorical questions, sarcastic tone, and wild assertions. This was done with the purpose of trying to shock the system so that for some maybe these extremes make them see things or think of things differently.

For those that took the time to indulge my efforts in this article and leave with the same impression you started that I’m off tilting at windmills, well, then I’m sorry to have wasted your time. However, my hope is for most there were at least some things and some ideas that provoked more questions or ideas.

And finally, for the others who found themselves agreeing with me, nodding your head while you read, and pumping your fist thinking, “man, he is right,” (ok, that last one I know was a stretch), well I have news for you too…I hope you have lots of metal polish around to shine up your suite of armor because you are clearly just as crazy as me.